The European Innovation Council (EIC) is focussed on the issue of converting the research occurring in the EU into impact through startups. Over the last 25 years, the EU has become ever more ambitious with funding pan-European research programmes. However, the translation of this research into new companies delivering the fruits of this research and innovation were thinner on the ground than was expected. Part of the EU effort to redress this issue was the establishment of various company funding instruments including the EIC’s Accelerator fund.

With the EIC having another call for Accelerator funding applications closing next month, I thought I’d have a look at the performance of Irish companies over the last 6 years.

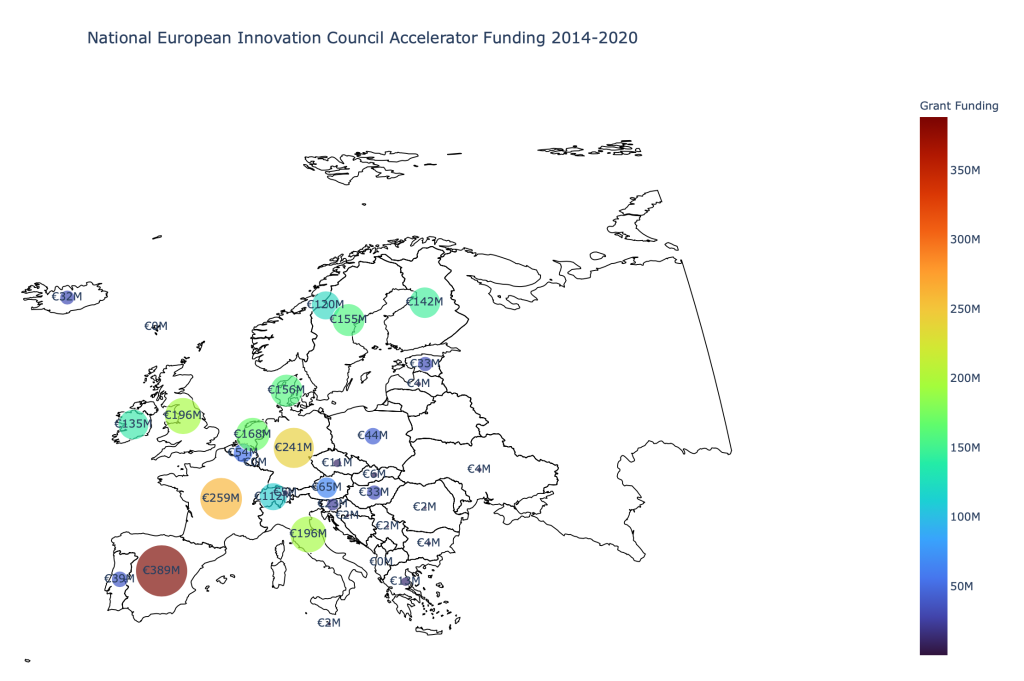

The Accelerator programme provides for both grant and equity investments in European companies. Shown here is the grant portion of the investments which can range from €50k to €2.5M per company. Startups such as Dublin City University spinouts Remedy Biologics and Novus Diagnostics have benefited recently from this instrument. Overall, Ireland ranks 11th for receipt of Accelerator grant funding, slightly below but not far off from innovation intensive economies of similar population size such as Finland and the Netherlands.

Breaking out the Irish data, some 164 projects have been funded amounting to almost €135M in recent years. The most projects were funded in Dublin (72) followed by Galway (23) and Cork (18). Here I divide the projects into the three broad categories of Lifesciences (Life), Information and Communication Technologies (ICT) and Manufacturing, Engineering, Energy and Construction (MEEC). Lifesciences is the largest category overall (72 projects) followed by MEEC and ICT. Whilst Dublin is still the largest beneficiary in each category, we can see Galway with its vibrant medtech sector as a close second in the Lifesciences. In ICT, it is Cork that is the second largest beneficiary. In MEEC, Limerick followed by Galway are the next largest counties. In the cases of counties with the largest numbers of these awards, it is likely that the presence of cities and third level institutions are closely associated with the fertile and supportive environment that is necessary for larger groupings of innovative new companies to emerge with the right type of opportunity to benefit such large scale investment.

With the next call for EIC Accelerator funding closing in mid-June, it is worth investigating for early stage companies with truly innovative and disruptive technology offerings. The monies (€2.5M in grant and up to €15M in equity) can be truly transformative for successful applicants. Each of the EU member states has a National Contact Point (NCP) for this and other European Commission funding initiatives. If you’re thinking of applying, they are a great source of information, guidance on the documentation needed and assistance in finding partners. In Ireland, see https://horizoneurope.ie for your NCP and more information.