Last night Knowledge Transfer Ireland published their Annual Knowledge Transfer Survey. The survey provides an overview of Irish third level Research Performing Organisation (RPO) funding, industry collaboration levels and commercialisation activities related to research through spin outs or licensing of IP to existing companies. The survey covers universities, institutes of technology, state research bodies and technological universities.

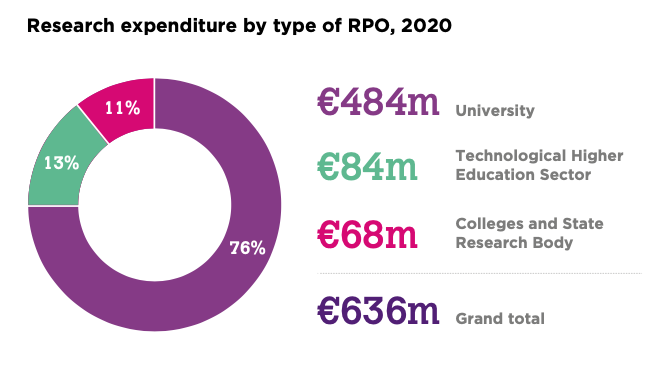

Some €636M was spent in 2020 on research by RPOs in Ireland. I restrict myself to university performance here.

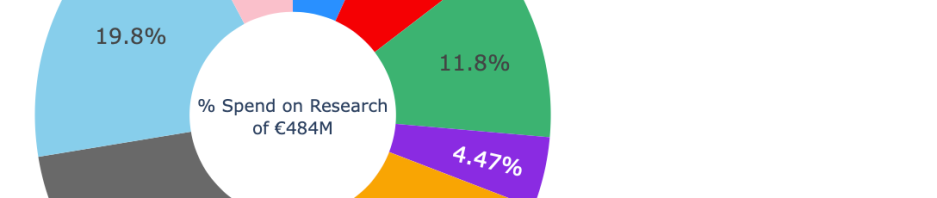

One of the first challenges that arises in comparing commercialisation performance and industry interaction is that each university naturally has a different amount of funding or research scale. One way to normalise for comparison purposes is therefore to look at performance against key metrics of commercialisation success and industry interaction per €10M research spend.

In the first instance, I chose to look at Invention Disclosure Form (IDFs) levels as these are a measure of how much of the research is of possible commercial interest. They are filled in and submitted to the university Technology Transfer Office when a researcher has some new work they feel is ready to be the basis of some intellectual property protection and subsequent licence to industry or a spin out. As such, IDFs can be though of as being at the start of the commercialisation pipeline in a university. The average is 6.4 IDFs per €10M spent.

At the the other end of the commercialisation funnel, we have a measure of how many of the technologies arising from research that are captured by IDFs are then actually commercialised. This occurs via agreements to licence, assign or option (LOAs) the technology and intellectual property in question to a company. For especially disruptive technologies, a spin out or new company is often the entity an LOA is given to and these are captured here, too.

I’d note that Dublin City University (disclosure of my own – I work there) is doing comparatively well. DCU has the highest level of IDFs per €10M, NUIM the lowest but the other universities are clustered around the mean. DCU also does well in commercialising its research via LOAs and spin outs. It’s notable that spin outs suffer from the law of small numbers in that it’s a metic that can move markedly around a small base each year in each institution. Hence there are some zeros this year.

The AKTS survey contains a very good overview of other trends. For examples, there seems to be a decline overall in patentable IP being commercialised whereas other other forms of intellectual property such as the copyright inherent in software is increasing in importance to industry. An average of 28 spinouts emerge from the third level sector – this year there were 30, of which 25 arose from the universities. There were a total of 39 new product and service launches in 2020 arising from licences of IP from the third level concluded in recent years.